Estimated reading time: 2 minutes

EMV seems to have migrated its way into the industry very smoothly, however, some are still hesitant in doing so. Several thousand business owners are on the fence as to whether they would like to hop onboard with the payment processing trend. EMV is seemingly predicted to be the most painless method for accepting and processing transactions, however there is risk of fraud and security breach on the horizon. There are ways to handle this safely, and knowing the difference between fully-integrated solutions and semi-integrated solutions can benefit VARs immensely.

EMV seems to have migrated its way into the industry very smoothly, however, some are still hesitant in doing so. Several thousand business owners are on the fence as to whether they would like to hop onboard with the payment processing trend. EMV is seemingly predicted to be the most painless method for accepting and processing transactions, however there is risk of fraud and security breach on the horizon. There are ways to handle this safely, and knowing the difference between fully-integrated solutions and semi-integrated solutions can benefit VARs immensely.

Fully-Integrated vs. Semi-Integrated Solutions

Fully-Integrated Solutions

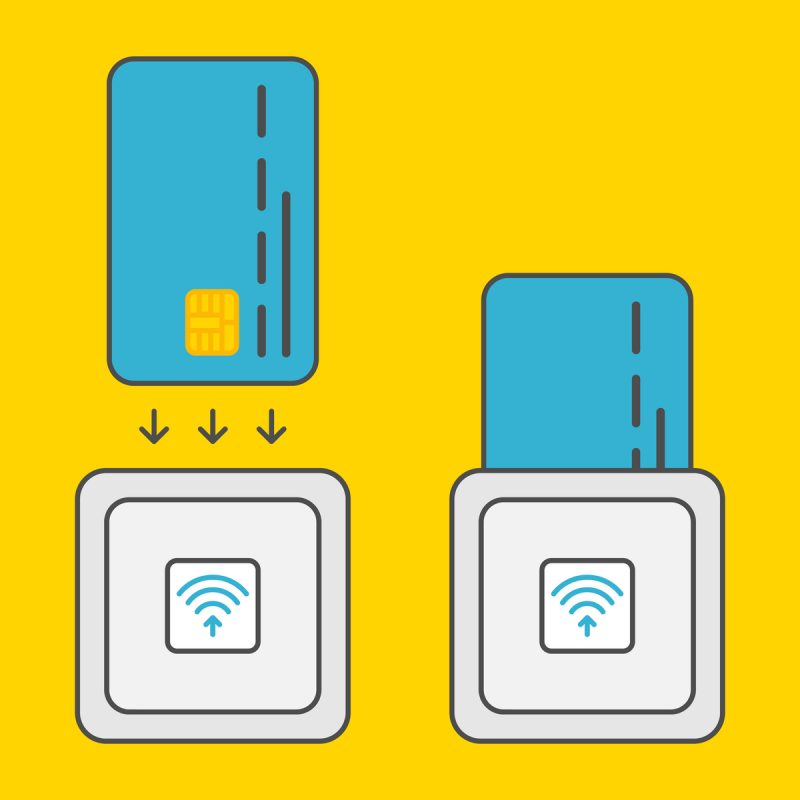

Through fully-integrated solutions, the payment application is combined with the POS solution. This handles every part of the transaction, from including payment processing, barcode scanning, payment tendering and inventory managing. Customer Relationship Management (CRM) and accounting activities are also integrated as well. Fully-integrated solutions work to help merchants save time and money. Additionally, merchants can track their surge in sales and establish financial transparency internally.

Fully-integrated solutions will utilize a PIN pad and/or signature pad connected to their hardware terminal. This hardware will communicate data directly to the network. Though it is viewed as risky, there is a need for ongoing EMV re-certification for any POS modification, as time goes on. This can result in additional expenses and delays for participating business owners.

Semi-Integrated Solutions

Through semi-integrated solutions, card holder data bypasses the POS terminal. It is directly transmitted from the card reader to the gateway. Through using encryption and tokenization, an additional sense of security is multiplied into the equation. Business owners should also take note that typically separate software is applied at this point in the process. Resellers should take advantage of the ease of use and cost efficiency of these semi-integrated payments. Overall, they increase sales and revenue streams as a whole.

Through semi-integrated solutions, card holder data bypasses the POS terminal. It is directly transmitted from the card reader to the gateway. Through using encryption and tokenization, an additional sense of security is multiplied into the equation. Business owners should also take note that typically separate software is applied at this point in the process. Resellers should take advantage of the ease of use and cost efficiency of these semi-integrated payments. Overall, they increase sales and revenue streams as a whole.

Benefits of Semi-Integrated Solutions

- Faster EMV Certification – Semi-integrated solutions come equipped with a wide range of hardware terminal options. They eliminate PC-based POS systems, which reduces the number of certifications required throughout the process.

- Easy Implementation – Easy implementation or “plug-n-play” is utilized when ISVs work to curate the appropriate software to satisfy a merchant’s needs. Implementing a semi-integrated solution is extremely quick, especially depending on the complexity of the specific application. They can also be used more popularly with mPOS functions.

- Once these solutions are certified to contactless standards and integrated to the appropriate NFC reader, mobile systems will be able to handle and accept contactless payment using accurately supported payment processing platforms.

- Simple Ownership – It’s been formulated simply that these software updates involved with Semi-integrated solutions don’t hold a negative affect on payment functionalities. Internally, business owners won’t need to worry about reconfiguring or re-certifying software. Working with ISV partners can resolve any bumps that arise at any point in the path.

As a VAR, the ball is in your court. You get to choose how to sell to your customers. Enhance your semi-integrated solution offering by combining it with add-ons, such as: NFC readers and even the potential for loyalty/reward programs to become a potential differentiator. This will allow the merchant repeat business with their customer base and even strengthen the relationship them and you, the VAR. It’s no surprise that merchants would seek out semi-integrated solution, for they are well-rounded and offer many benefits.